North Carolina Investment Account “Churning” Lawyers

What Is Investment Account “Churning”?

Account churning occurs when a stockbroker, brokerage firm, or investment advisor excessively trades in order to receive more commissions for selling stocks even though the stock may be generating revenue. Churning is illegal and unethical because the investment professional trades to collect commissions for themselves rather than acting in the best interest of the investor. Churning may result in substantial losses in an investor’s account and even if the trades are profitable, they may generate a greater than necessary tax liability for the client.

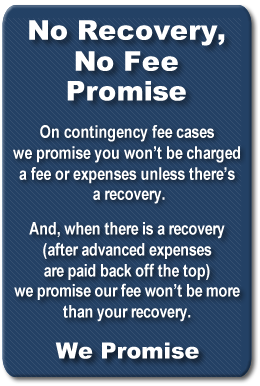

If your stockbroker is charging you excessive commissions and you have reason to suspect that your account has been churned, contact the North Carolina investment fraud lawyers at the law firm of Hemmings & Stevens, PLLC today. We offer free initial consultations and work on a contingent fee basis, which means there are no fees unless we make a recovery for you. You can call us at 919.277.0161 or contact us online . Our office is in Raleigh, but we handle investment fraud cases statewide.