North Carolina Lawyers for Insurance Bad Faith

An insurance company has many duties to its policy holders. First, it has a duty to defend a claim (or lawsuit) even if some, or most, of the lawsuit is not covered by the insurance policy. Second, it has a duty of indemnification, which is the duty to pay a judgment against the policy holder up to the limit of coverage, but only if the judgment is for a covered act, or omission. As a result, most insurance companies exercise a great deal of control over litigation. Finally, the company has a duty to pay a claim for loss if it is covered under the policy.

Insurance Bad Faith refers to a claim that an insured person has against his or her own insurance company for refusing to defend a lawsuit or pay a claim. Under the law of nearly every U.S. jurisdiction, insurance companies owe a duty of good faith in dealing with the persons they insure. If they violate that obligation, many states, North Carolina being one of them, allow the insured person to sue the insurance company.

In North Carolina, the state law allows punitive damages against insurance companies as a mechanism to prevent future bad behavior. Additionally, the North Carolina Commissioner of Insurance also has the right to punish insurance companies for this behavior under the State's Unfair Claims Practices Act.

Examples of insurance bad faith and unfair claims practices include:

- Delay in handling claims

- Deliberately delaying payment

- Inadequate investigation of a claim

- Threats against you

- False reports that you have committed a crime

- Rude or unprofessional communications with you

- Refusing to make a reasonable settlement offer

- Making unreasonable interpretations of an insurance policy

- Refusing to reimburse you entirely for your loss

- Refusal to defend a lawsuit against you

- Making misrepresentations to you about your policy

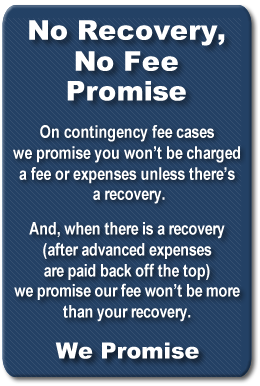

At the law firm of Hemmings & Stevens, PLLC, we have litigated these Insurance Bad Faith issues in numerous cases in State and Federal Court, and have the experience to advise you and handle your case in a manner that will place you in the best position to recover the benefits you deserve.

This article regarding North Carolina Insurance Bad Faith is for informational purposes only and is not legal advice. You may need to seek the advice of an Insurance Bad Faith lawyer at the law firm of Hemmings & Stevens, PLLC, that has experience in these matters, to help you, if you have an Insurance Claim in dispute.